CARES ACT Paycheck Protection ProgramFact Sheet

Fact Sheet

Summary

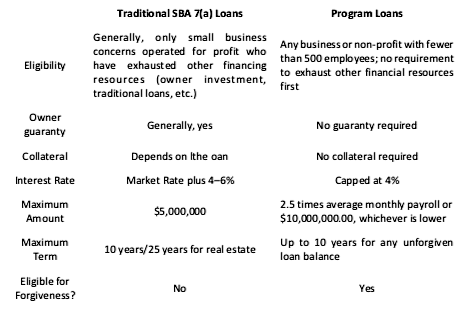

Title I of the Coronavirus Aid, Relief, and Economic Security Act (the “Act”) amends the Small Business Act to create a new “Paycheck Protection Program” (the “Program”). The Program allows essentially any business or non-profit with fewer than 500 employees to obtain low-interest, no-collateral loans from the SBA from February 15, 2020 to June 30, 2020 to cover operating costs. Further, under the Program, eligible employers are entitled to have up to the entire amount of their loan forgiven provided the employer has maintained employment levels during the pandemic.

Who is Eligible

Any business concern or non-profit organization who employs fewer than 500 people is eligible for the Program, regardless of whether such business or non-profit would otherwise ordinarily qualify for an SBA loans. Additionally, persons who are sole proprietors, independent contractors, or who are otherwise self-employed are also eligible for Program loans. Borrowers are only required to certify at the time they obtain the loan that (i) the uncertainty of current economic conditions forced the borrower to take out the loan in order to support the borrower’s ongoing operations, (ii) they acknowledge that they must use the funds to pay for payroll, mortgage interest, lease payments and utility payments; and (iii) that they do not have any other SBA loans or pending applications seeking to cover the same expenses.

Eligible Loans

Loans made by the SBA from February 15, 2020 until June 30, 2020 are eligible for the Program.

Borrowing Limit

Loans eligible for the Program are generally limited in amount to the lower of 2.5 times the business’s average monthly “payroll cost” during 2019 (with special rules for seasonal business or business who were not open during all of 2019), or $10,000,000.00, whichever is lower. For the purposes of the Program, a business’s payroll cost is broadly defined to include all salaries, wages, commissions or other similar employment compensation; payments for employees’ vacation, sick, or parental leave; payment of health insurance premiums or retirement benefits; and state or local taxes assessed on employee compensation, but excludes any leave payments made under the Families First Coronavirus Act for which businesses will receive a refundable tax credit, or federal taxes. Further, at the individual employee level, payroll costs are also capped at $100,000.00 per employee, i.e., if an employee earns more than $100,000 per year, the sums over $100,000 are not counted as part of the employer’s payroll cost.

Use of Funds

The borrowed funds may be used by the employer for any business purpose already authorized by SBA section 7(a), including purchasing land or buildings, equipment, machinery or supplies or for working capital. Additionally, the Program expands permitted uses to allow loan funds to be used to pay payroll costs, health care benefits costs, salaries, mortgage interest, rent, utilities, and interest on any other debt incurred prior to February 15, 2020.

Interest Rates/Repayment Terms

Interest rates on eligible loans are capped at 4%. Further, each loan taken out during the period of February 15, 2020 to June 30, 2020 is eligible for automatic payment deferment (i.e., no principal or interest payments are required) for a period of not less than six months up to one year.

Required Collateral and Guarantees

SBA collateral and personal guaranty requirements for Program-eligible loans are waived. Business owners are not required to either pledge collateral or personally guarantee the loan. Further, the loans are 100% guaranteed by the SBA.

Loan Forgiveness

Unlike traditional SBA 7(a) loans, Program loans are eligible for forgiveness in an amount equal to the amount spent by the Borrower on payroll costs (as defined above), interest on mortgage obligations, rent, or utilities (so long as such mortgage, lease, or utility account was established prior to February 15, 2020) during the eight week period following the origination of the Program loan up to 100% of the loan amount. The amount eligible for forgiveness is reduced, however, by (i) a proportion equal to the ratio of employees no longer employed by the employer during the eight week period as compared to before the COVID-19 outbreak and (ii) by the amount of any reduction in pay to current employees during the eight-week period of more than 25%.

Loan Forgiveness Calculation Example

A borrower borrows $100,000.00 under the Program on May 1. From May 1 to June 30, the borrower spends $125,000.00 on payroll, rent, and utilities. Prior to the pandemic outbreak, the borrower had, on average, 15 full-time employees. During the eight-week period following origination of the loan, the borrower’s workforce had been reduced to 10 employees, with the pay of two of these employees each being reduced by $2,000.00 from normal during the eight week period, which is more than 25% reduction of their normal pay.

In this example, the borrower has only maintained 2/3 of its prior employment during the eight week period. Thus, of the $125,000 spent by the employer on eligible costs during the eight week period, only 2/3rds, or $83,333.25, is eligible to be

counted for loan forgiveness. Additionally, because the borrower reduced salaries of employees by $4,000.00, this sum is further reduced by $4,000.00. Of the original $100,000.00 Program loan, the borrower is eligible to have $79,333.25 of the loan forgiven and must repay only $20,666.75. The borrower will have a maximum 10 years to repay the balance.

The Jiles Firm, P.A. is a business law firm located in Conway, Arkansas practicing in business and commercial law, labor and employment law, and business litigation. During the COVID-19 crisis, The Jiles Firm, P.A., attorneys are offering free telephone consultations with small businesses and non-profit organizations concerning legal issues caused by COVID-19.